“When you spend money before you pay yourself first, you’re training yourself to be a consumer. When you pay yourself first, you’re training yourself to be a saver.”

-Rory Douglas

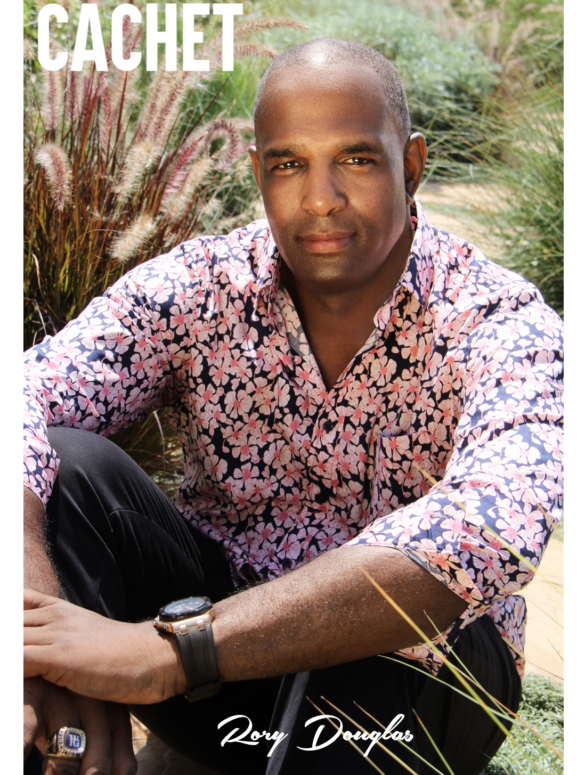

Cachet Digital caught up with finance expert Rory Douglas for an exclusive photo shoot and also to pick his brain on the world of finance. 2020 has been quite a year and a big topic is financial stability. With so many unprecedented events against the backdrop of the economy grappling with coronavirus managing money is beyond important. Sure we all know the basics and some may be more educated than others but be honest…

Is it a part of your daily lifestyle?

With Instagram culture and social media showing no sign of slowing down, it is key to have a financial structure to adhere to and guidance in general when it comes to money. Every second we are bombarded with ads linked to our browsing history that encourages us to buy. However, to become wealthy and build a comfortable legacy; discipline is required. Even if you feel that you just want to have modest goals, structure helps make those goals more attainable.

People often mismanage their money and do not know enough to keep on top of their finances. Making good money decisions helps provide a better life and future. Check out our interview with Rory to learn a bit more about him as well as “get up on game” on how to win when it comes to managing your money.

Making money, keeping it and making money make money is a skill. Rory Douglas has a few tips on how you can become fluent in the language of money or finance.

So tell us a bit about your upbringing and how you arrived to where you are today:

I went from the streets to corporate suites. In my youth, I was labeled as a problem. I was kicked out of Elementary and High School. Although I was highly gifted, I suffered from dyslexia unknowingly. In an attempt for me to avoid embarrassment in school, I would act out during my classes.

One day my mother asked for me to read the driving instructions while we were on our way to a destination. I objected, but she insisted. That was the day my mother knew something was wrong. She then went to my school and spoke to my counselors, and it wasn’t until that point that I was officially labeled as dyslexic.

Although it was challenging at times, I beat my disability. I tell people that you may have a disability, but you are not disabled. Once I received help, I returned to school and received straight A’s. Attending school did not keep my attention; it was too slow. I started working at a young age. That was the start of my journey.

What do you do in a nutshell?

I show people how to make money, save money, and protect themselves.

What are key first steps for those wanting to grab control of their finances?

The first step is to make sure that when they get a check or any money, they pay themselves first. You want to create a habit of paying yourself first. When you spend money before you pay yourself first, you’re training yourself to be a consumer. When you pay yourself first, you’re training yourself to be a saver.

What is a challenge you faced and how did you overcome it?

The hardest time I faced at the beginning of my journey was getting over my fears. These fears were deep-rooted from my childhood. These fears were deep-rooted from my childhood. As I grew into my profession; I was met with the challenges of finding my niche, my passion, and my acceptance of self.

What mantras or life lessons have helped you most to get where you are today?

I often asked myself, ” Do I have what it takes to make it?” It wasn’t until I had my mentor that I had a complete life transformation. What I’ve learned is that once you find your passion, you’ll find your purpose and that there are never losses, only lessons.

What are some of the biggest misconceptions people have when it comes to seeking out someone to help them get their financial life together?

That they don’t have to apply the recommendations given or that they have time that they don’t have when making financial decisions. Sometimes the money is really on the line, and you can miss your mark if you don’t act quickly. A client is successful when they follow the financial plans that I give them for their future. I gauge their success according to their quarterly reviews that I have with them. Don’t forget, winning is a habit, and losing is a habit as well. Those clients who follow instructions and develop winning habits always come out on top.

What can we expect from listening to your podcast? We hear a lot about “life coaching” on IG but you are very fluent in all things finance. Why do most people come to you for within these coaching sessions and how did you get into doing so?

The podcast is informative and educational. I take my life experiences in the areas of Financial Literacy, Artificial Intelligence, Motivation, Inspiration, and Entrepreneurial Insights to encourage and motivate people to pursue their purpose. Podcasts are one of the most successful tools when it comes to getting information out in an unfiltered/intimate manner. It’s as if you are talking to the individual directly.

So we had a great time checking out your website. Rorydouglas.net is your online portal for so much. Who is the target audience and how can they best use the site:

My target audience is like-minded or aspiring individuals. My audience varies from Entrepreneurs to professionals and scholars. Anyone eager to grow and learn fit well within my organization.

Where do you see your brand going in the next few years:

In the next five years, I see myself being one of the top Motivational Speakers in the world.

What do you enjoy most about public speaking and speaking engagements?

What I enjoy most is speaking to massive crowds. I love to use my gift of connecting with people through education, motivation, and speech, knowing that they are walking away with something that will last them a lifetime and not lunchtime.

What message should parents emphasize to their children (those who are under 18 and also those in college) on how to structure any saving they have while they have them still under their wing?

It’s not about how much money you make that counts; it is how much you keep. Now that you are with your parents; take full advantage of the time you have by saving as much as you can. Make sure you study plans that you could put money in like the S&P 500 and Mutual Funds when you are prepared.

How can our readers learn skills that they can use financially?

You can learn financial skills by listening to podcasts, buying finance books, and getting involved in the financial community.

How can our younger readers find out more about your career path?

My firm Aqua Financial is always open to interns and mentees. Students can visit www.aquafinancialcenter.com for more information and see my interview geared towards their age group for Cachet Junior.

Keep up with all things Rory Douglas by following him on IG via @RoryKDouglas!

Photography and interview: @lovelenaocean

Photo Shoot Set Assistant: @thealexandriawood